The smart, easy way to quickly compare state payroll laws, side-by-side!

When your job entails compliance not only with the state payroll laws for your company’s headquarters but those of other states as well, you need CCH's State Payroll Law Compare. This invaluable resource lets you instantly evaluate the differences between jurisdictions — comparing topic-by-topic for each state.

While federal payroll laws may not change that frequently, the pace at which state laws evolve can be dramatic. And, with more companies now employing people in multiple states, the need for an easier way to analyze and compare payroll law requirements across multiple jurisdictions has never been greater. State Payroll Law Compare has the answers.

A complete Internet-based state payroll law resource, State Payroll Law Compare provides succinct summaries of state payroll laws, as well as federal law summaries.

Advanced “Smart Chart” functionality

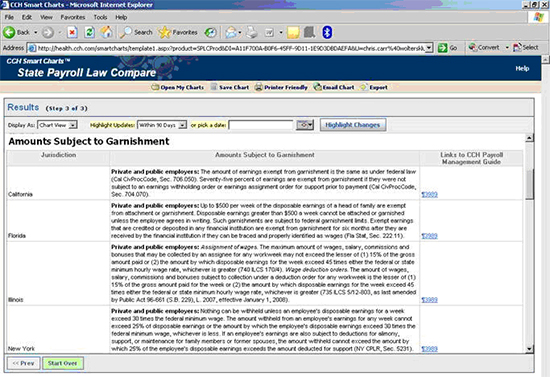

State Payroll Law Compare's intuitive interface lets you choose from dozens of topics, then instantly compare multiple states' laws on that subject in a convenient chart format. You decide how many and which states you wish to compare. The search results, displayed in an easy-to-read chart format, include citations.

Includes CCH "Smart Chart" functionality. Select a topic (such as Garnishment), then instantly compare laws across as many jurisdictions as you need—side by side!

State Payroll Law Compare allows you to easily compare the laws from within the following topics:

To order, or for more information on State Payroll Law Compare, call

1-800-344-3734 or email us to speak to a sales representative.

What's NewFor Any Question, We Have the AnswerWolters Kluwer Law & Business offers a full array of resources designed to meet the demands of busy payroll professionals. Whether you need quick answers to commonly asked questions or expert guidance on more advanced topics, we have the right resource to fit the size, scope and complexity of your organization. |

Top SellersComplete Guide to Federal and State GarnishmentAspen Publishers' Complete Guide to Federal and State Garnishment provides much-needed clarity when the federal and state laws appear to conflict. You'll find plain-English explanations of the laws and how they interact, as well as the specific steps you and your staff need to take to respond to the order properly. |